It is sometimes very difficult to know how much of your wages you are actually taking home. Among the federal taxes, state taxes, FICA contributions, and pretax deductions, a lot of workers do not estimate the amount that is taken out of their paycheck. An effective US Pay Calculator will eliminate the guesses with a clear and transparent breakdown of where each dollar will be spent, allowing employees to plan, budget, and negotiate with confidence.

What Is a US Pay Calculator and Why Does It Matter

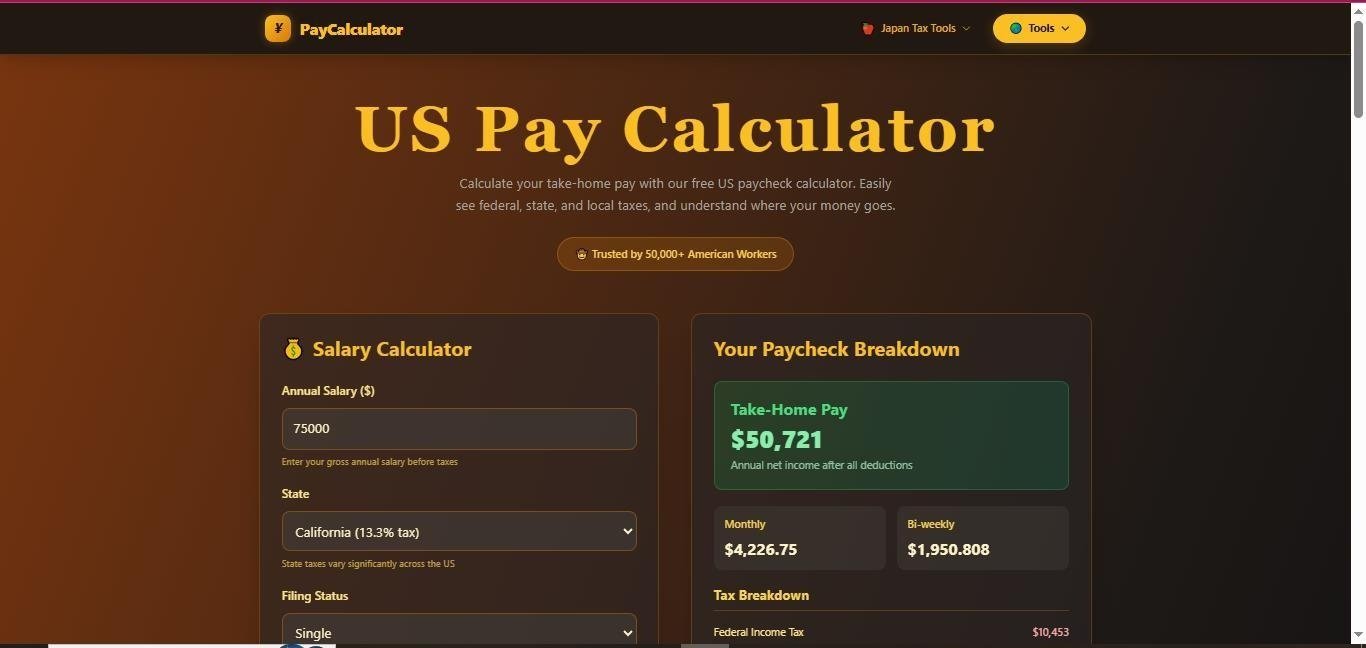

A US Pay Calculator is a web-based application used to calculate your actual take-home compensation based on your gross salary. It uses computation instead of rough estimations to compute federal income tax, state income tax, social security, Medicare, and optional withholding, like retirement or health benefits. This enables the workers to correctly assess their results in the form of their gross to net salary US before they take up a job offer, requesting an increase in salary or benefit contributions.

Most Americans are concerned about the amount of salary they get per annum, but the real measure of lifestyle, savings potential, and financial stability is the net income.

Population of Gross to Net Salary US.

The sum of money you make before any cuts is known as Gross salary. The net salary, sometimes also called take-home pay, is the salary left after taxes and withholdings. A quality calculator shows:

- Federal income tax, which is computed on progressive tax brackets.

- State income tax that is diversely different across states.

- FICA taxes, such as Medicare and Social Security.

- 401(k), health insurance, HSA, or FSA pretax deductions.

When employees see these parts in conjunction, they can have a realistic image of the effective tax rate instead of concentrating on marginal tax rates.

How the state taxes affect the amount of take-home pay.

Net income is significantly contributed to by state taxation. Some states do not have any form of income tax, and there are states that have high progressive rates. The state required on a US Pay Calculator is a critical selection since, depending on your state of residence, you are liable for a particular amount. To higher incomes, the high tax-no tax state can run a difference of several thousand dollars per year, which can drastically change your gross to net salary US outcome.

How Pre-Tax Benefits Improve Net Income

The impact of pretax benefits is one of the most potent pieces of information that a pay calculator can give. Investments in retirement plans or health-related accounts decrease taxable i ncome, and this decreases federal and state taxes. Even the small changes can have a positive, meaningful impact on the monthly take-home salary and bolster the sustainability of financial health in the long term.

Beyond Budgeting: Practical Applications.

Budgeting is not the only thing to do with a US Pay Calculator. It is a strategic instrument of salary bargaining, career planning, and moving. Recognizing the fact that an increase does not necessarily focus dollartodollar on net compensation motivates more savvy bargaining (like demanding more benefits or more adaptable compensation packages).

Conclusion

It is imperative to know the exact amount of take-home in the current tax complex world. A US Pay Calculator in modern times enables workers by transforming the daunting tax regulations into simple and straightforward actionable information. correctly calculating the conversion of gross to net salary US will make you budget, maximize benefits, and make better career choices. Once you know what happens to your money, then you will have the power to control the way it flows your way.