Most people pay attention to annual gross salary when considering a job offer or budgeting money when assessing a job proposal. Nevertheless, gross salary is not what you get home. Your earnings are lowered by taxes, compulsory contributions, and employee perks. This can be filled in by a current-day US Salary Calculator, which provides a clear, itemized display of deductions and net income so that more precise financial planning can be done.

How a US Salary Calculator Works

Entering Core Salary Details

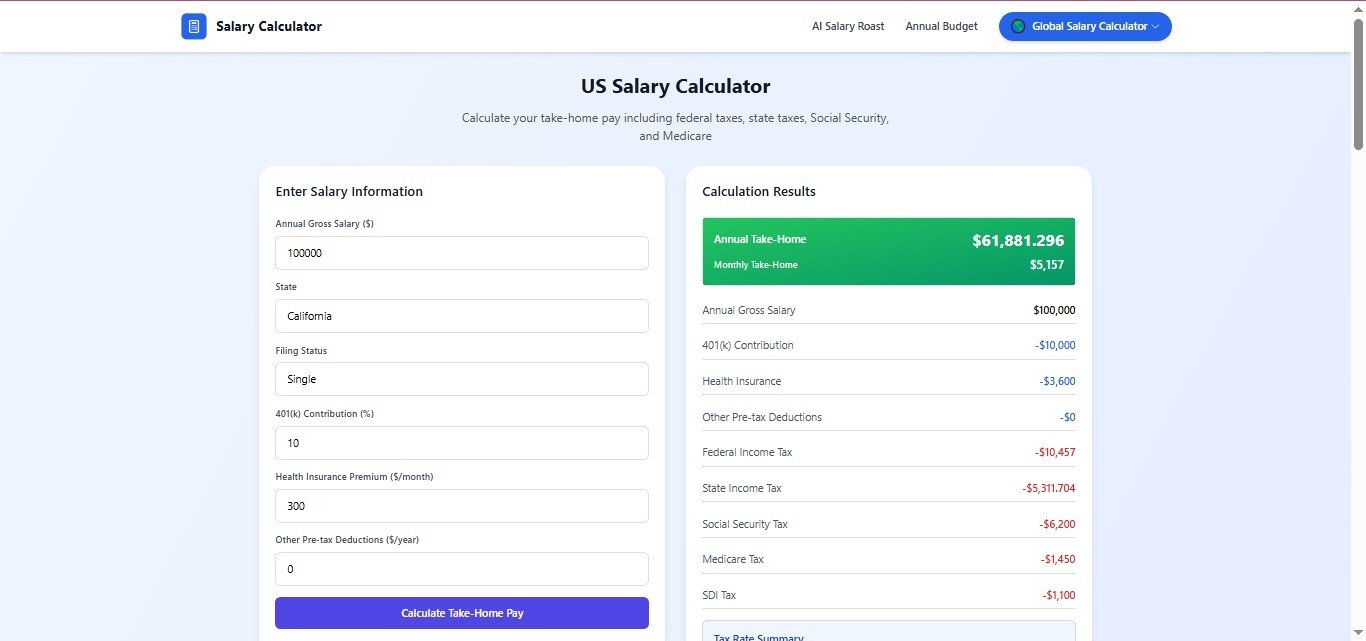

The process commences with the basic inputs like annual salary, state of residence, and filing status. The variables are necessary in the sense that the rules of tax filing vary vastly depending on your dwelling place, as well as your filing method.

Accounting for Taxes Automatically

A good calculator uses the existing federal and state tax laws, so that the calculations based on the US income tax will be based on the real-world regulations. This eliminates the ambiguity of handwritten estimates and obsolete tax tables.

Breaking Down US Income Tax

Federal Income Tax Explained

The federal tax system is progressive, implying that income is taxed in strata. The various parts of your salary are in various tax brackets; the first part is lower tax rate, and then higher tax rates after a certain amount of money. Standard deductions and filing status contribute significantly to the amount of money that you will pay in tax.

State Income Tax Differences

State taxes vary widely. Some states do not have income tax, and those with rather high rates. This is important in knowing the differences in order to compare job opportunities or when relocating. These differences are automatically reflected in a US Salary Calculator without the need to be calculated manually.

Payroll Taxes and Compulsory Contributions

Social Security and Medicare.

Social Security and Medicare programs are financed by payroll taxes. Social Security has a certain limit on wage whereas Medicare is imposed on the entire income earned, and high earners have to pay extra taxes. They should not be ignored, as such deductions may have a huge impact on net pay.

Why Itemization Matters

The presence of payroll taxes as a separate item makes it easier to comprehend why the amount of money that a user can take home might seem lower than projected prior to taking into consideration income taxes.

Income and Savings PreTax items, YTD.

Retirement Contributions

Funding towards a conventional 401 (k) lowers taxable income and sustains long-term retirement objectives. These contributions, when keyed into a calculator, tend to provide a phallic decrease in the total taxes payable.

Health Insurance and Other Benefits

Health insurance benefits. Health insurance coverage covers routine checkups, medication, and hospital charges.

The employer-sponsored health insurance premiums are normally pretax deductibles. This reduces taxable income and enhances efficiency in reward planning.

Taking Salary Estimates and Making Better Decisions.

Comparing Job Offers

The salary estimate offers a detailed picture that professionals can use to compare their offers, especially where the jobs are in various states with various tax structures.

Planning for the Future

The long run planning is also supported by the salary calculators and assists the users in estimating the increments, bonuses, or variations of the benefits before they occur.

Conclusion

US Salary Calculator is a product that simplifies the complicated rules of taxes and deductions into simple, actionable information. The correct modelling of taxes, benefits, and deductions gives a realistic salary estimate that helps in making smarter budgets, career choices,

and economic stability. When you know exactly what happens to your money, you will

have complete transparency with your income and have more control over your own finances.