Taxation management will no longer have to be complex or costly. As people and experts have increased access to modern tax tools online, possibnow le to compute income taxes, or estimated amounts to take- home pay, and plan confidentially using proper and up-to-date digital services. Taxtools.ai is created to make the life of American taxpayers easier as it is a suite of free-to-use tax calculators with tax year updated to 2025.

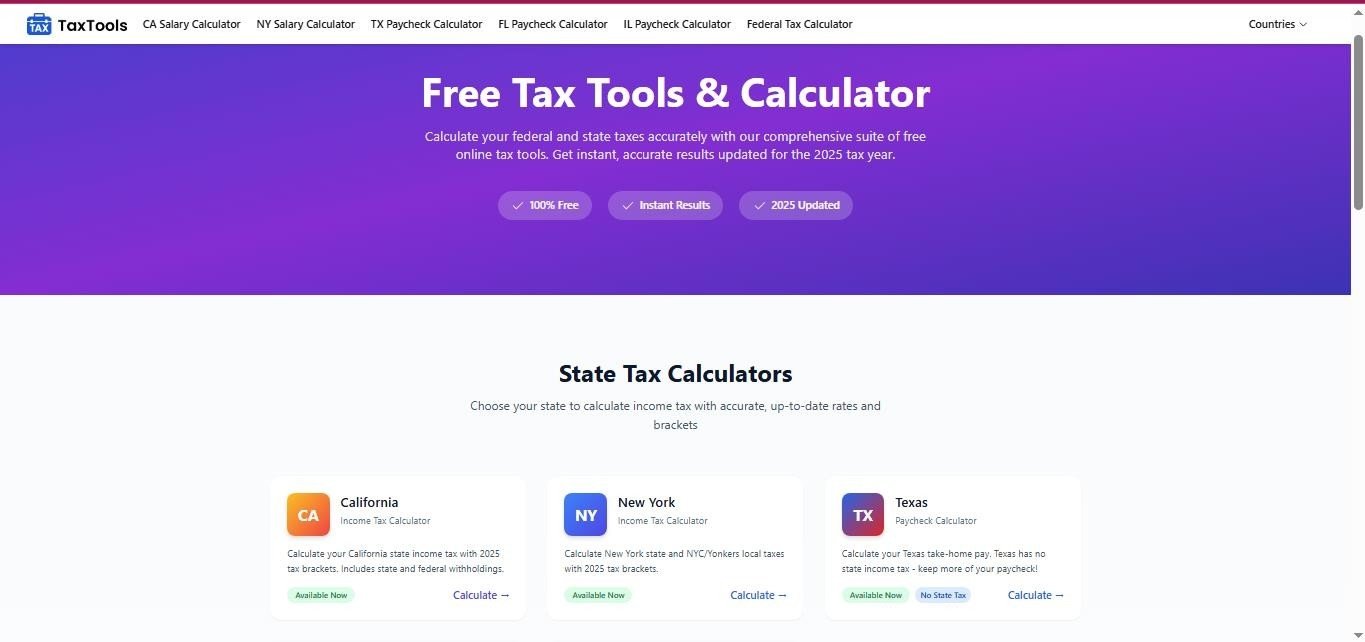

Taxes: A Full Suite of Free Tax Tools.

Taxtools.ai is unique because it offers its tax calculators free of charge, and there is no need to register. These are the tools for calculating taxation online that are designed to give immediate answers and are updated with the inquiries of the IRS, indexation with inflation, and tax codes that are state-specific. The platform can help you know your tax requirements, whether you are a salaried worker, freelancer, or self- employed professional.

The users can compute the federal income tax, approximate the state income tax, and plan on paycheck withholdings within a few steps. The simple interface will make sure that users lacking the tax pros will be able to get credible estimates within a short time.

State Tax Calculators Tailored to Your Location

Taxtools.ai has a growing collection of state calculators, which is one of its strengths. Tax regulations are different in each state, and the platform considers these variations to be very accurate. Now, a user can compute income taxation in states like California, New York, Illinois, Florida, and Texas, and all 50 states are in place.

An example is that states such as Texas and Florida do not have state income tax, whereas other states, such as California, have a progressive tax system. These differences are crucial parameters that should be understood when preparing a budget, planning relocation, or analyzing a job opportunity.

California Take Home Pay Calculator

One of the most popular tools on the site is the california take home pay calculator. This gives users an opportunity to determine their expected net income after including tax on federal income, state tax on income, both Social Security and Medicare, plus California State Disability Insurance (SDI).

The tax regime in California comprises various marginal tax rates that range between low taxation on the lowincome earners to high-income earners. The calculator realistically presents these brackets, so that the user will see a realistic breakdown of the deductions and net pay. This can be of particular use to professionals who need to compare salaries or budget monthly expenditure.

Accurate Calculations Based on 2025 Updates

Taxtools.ai is updated with all calculators every year in line with the latest tax laws. In 2025, the federal brackets, standard deductions, and FICA limits will be inflated. The data provided by the official IRS and state tax authorities ensures that estimates are good and up-to-date.

All users do is put in their income, filing status, and the frequency of payment, and in a couple of seconds, a detailed calculation is provided to them.

Conclusion

Tax estimation is a very important element of financial planning, and with the free digital solutions. It is now easier than ever before. Under Taxtools.ai, customers can browse dependable online tax tools and have access to specialized applications such as the calculator of take-home pay in California. All of which would save time and remove confusion. With the tax laws changing, the best way to make more intelligent decisions and have more financial confidence throughout the year is to have the new, user- friendly calculators.